A housing market crash can have a significant impact on mortgage obligations, affecting homeowners, mortgage defaults, foreclosure rates, and credit scores. This article explores the causes and signs of a housing market crash, as well as its effects on mortgage obligations. It also discusses government intervention and assistance programs, and the role of federal agencies in mitigating the impact. Finally, it examines the recovery and rebuilding process, including stabilizing the housing market and lessons learned from the experience.

Key Takeaways

- A housing market crash can lead to an increase in mortgage defaults and foreclosure rates.

- Negative equity is a significant consequence of a housing market crash, impacting homeowners’ financial stability.

- Mortgage relief programs and loan modification options are available to assist homeowners facing financial hardship.

- Federal agencies play a crucial role in providing assistance and regulating the mortgage industry during a housing market crash.

- Stabilizing the housing market and rebuilding homeownership are important steps in the recovery process.

Understanding the Housing Market Crash

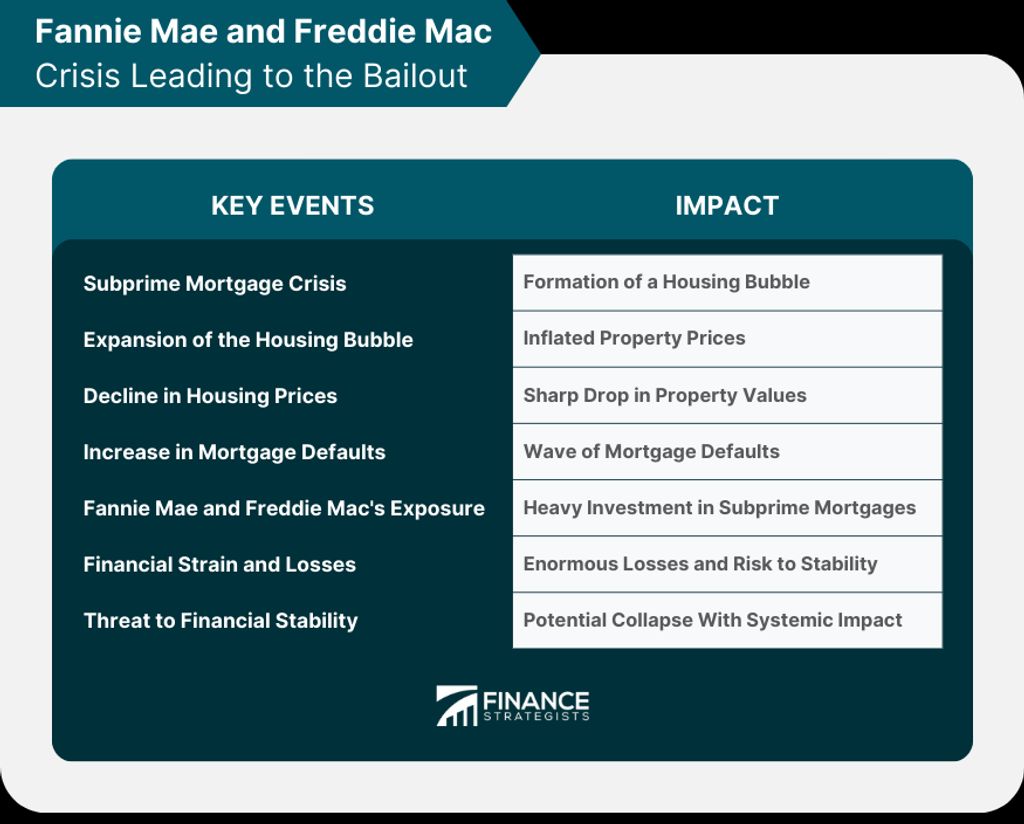

Causes of the Housing Market Crash

The housing market crash had significant implications for homeowners, lenders, and the overall economy. One of the key implications was the sharp decline in housing prices, which led to a decrease in home equity for many homeowners. This decline in home equity made it difficult for homeowners to refinance their mortgages or sell their homes without incurring a loss. Additionally, the housing market crash resulted in a surge in mortgage defaults as homeowners struggled to make their monthly mortgage payments. This increase in mortgage defaults put pressure on lenders and contributed to the rise in foreclosure rates.

Signs of a Housing Market Crash

There are several signs that can indicate a housing market crash. One of these signs is a decrease in property management. When property management companies start to struggle, it can be a sign that the housing market is in trouble. Property management companies are responsible for managing rental properties and ensuring they are occupied and generating income. When these companies start to see a decline in rental demand or an increase in vacancies, it can be an indication that the housing market is weakening. This is because a decrease in property management activity suggests a decrease in rental demand and a potential oversupply of rental properties.

Impact on Homeowners

The housing market crash has had a significant impact on homeowners. Many homeowners have experienced financial hardships and struggled to meet their mortgage obligations. Foreclosure rates have skyrocketed, leading to a surge in mortgage defaults. Additionally, homeowners have faced the challenge of negative equity, where the value of their homes is less than the outstanding mortgage balance. This has resulted in a decline in homeowners’ credit scores and limited their ability to access credit in the future.

Effects on Mortgage Obligations

Increase in Mortgage Defaults

Increase in mortgage defaults is one of the major consequences of a housing market crash. When the housing market crashes, many homeowners find themselves unable to meet their mortgage obligations. This can be due to a variety of factors such as job loss, decreased home values, or high interest rates. As a result, the number of mortgage defaults increases significantly.

Mortgage defaults can have a ripple effect on the economy as a whole. When homeowners default on their mortgages, it puts pressure on the banking system and can lead to a decrease in lending. This can further exacerbate the housing market crash and prolong the recovery process.

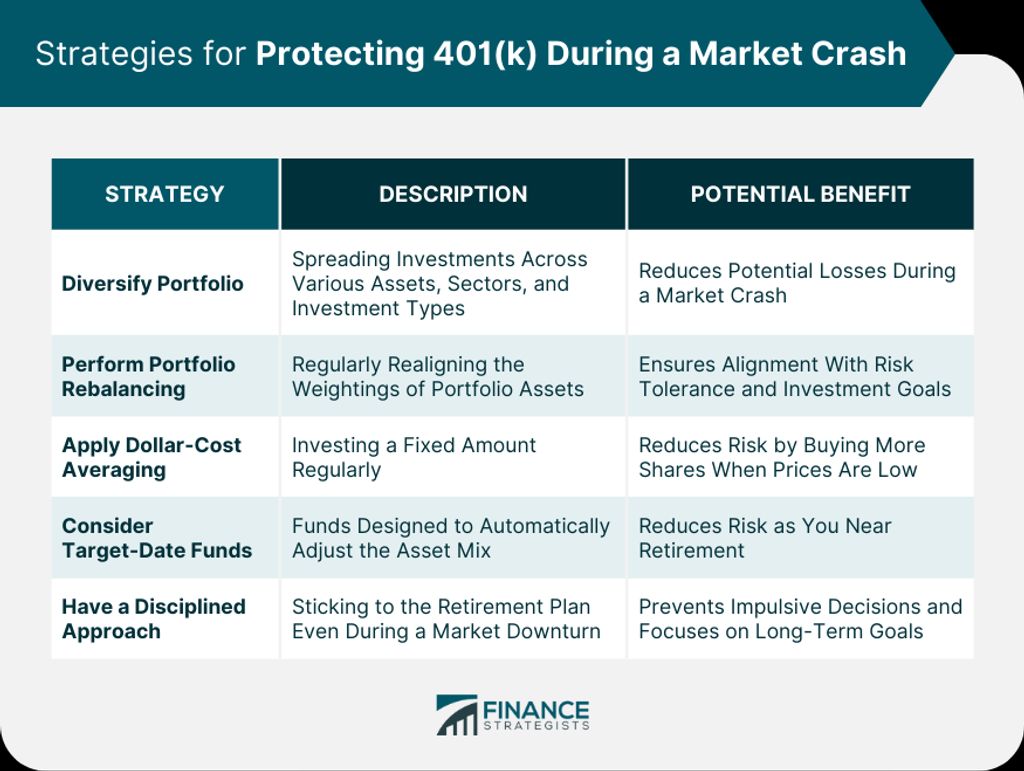

It is important for homeowners to be aware of the risks associated with a housing market crash and take necessary precautions to protect their investment journey.

Foreclosure Rates

Foreclosure rates are a key indicator of the severity of a housing market crash. When the housing market crashes, homeowners may struggle to make their mortgage payments, leading to an increase in foreclosure rates. This can have a devastating impact on individuals and families, as they may lose their homes and face financial instability. It is important for homeowners to be aware of the foreclosure rates in their area and take necessary steps to protect their homes and financial well-being.

Negative Equity

Negative equity occurs when the value of a homeowner’s property is less than the outstanding balance on their mortgage. This situation can arise due to a variety of factors, such as a decline in property values or an increase in mortgage debt. Homeowners with negative equity face several challenges, including limited options for refinancing or selling their homes. Additionally, negative equity can have a detrimental impact on a homeowner’s financial stability and future prospects. It is important for homeowners to be aware of the risks associated with negative equity and take proactive steps to mitigate its effects.

Impact on Credit Scores

The housing market crash can have a significant impact on credit scores. One of the key factors that can affect credit scores is the number of overdue payments. When homeowners are unable to make their mortgage payments on time, it can result in overdue payments, which can negatively impact their credit scores. Lenders report these late payments to credit bureaus, and they are reflected in the individual’s credit history. Overdue payments can stay on a credit report for up to seven years, making it difficult for individuals to obtain new credit or loans. It is important for homeowners to prioritize their mortgage payments to avoid damaging their credit scores.

Government Intervention and Assistance

Mortgage Relief Programs

Mortgage relief programs provide assistance to homeowners facing financial difficulties. These programs aim to alleviate the burden of mortgage obligations and prevent foreclosures. They offer various options such as loan modifications, refinancing, and temporary payment reductions. By providing relief, these programs help homeowners stay in their homes and avoid the negative consequences of defaulting on their mortgages.

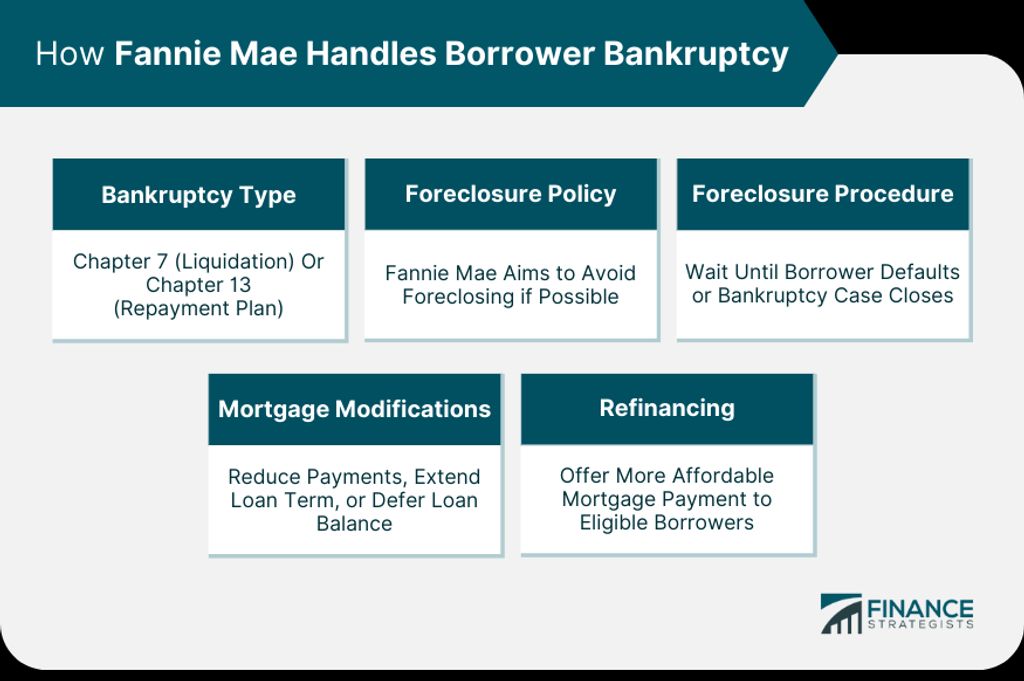

Loan Modification Options

When facing financial difficulties, homeowners may explore loan modification options as a way to alleviate their mortgage obligations. Loan modification involves making changes to the terms of the existing mortgage agreement in order to make it more affordable for the homeowner. This can include reducing the interest rate, extending the loan term, or even forgiving a portion of the principal balance. By modifying the loan, homeowners can potentially lower their monthly mortgage payments and avoid defaulting on their mortgage.

It is important for homeowners to understand that loan modification is not a guaranteed solution and may not be suitable for everyone. Lenders typically require homeowners to provide documentation of their financial hardship and demonstrate their ability to make the modified payments. Additionally, homeowners should be aware that loan modification may have long-term implications, such as extending the overall repayment period or increasing the total interest paid.

While loan modification can provide temporary relief, it is crucial for homeowners to also address the underlying financial issues that led to their mortgage difficulties. This may involve creating a budget, reducing expenses, increasing income, or seeking financial counseling. By maintaining cleanliness in their financial situation and taking proactive steps, homeowners can improve their chances of successfully navigating through the challenges of a housing market crash.

Role of Federal Agencies

Federal agencies play a crucial role in mitigating the impact of a housing market crash on mortgage obligations. They provide support and guidance to homeowners facing financial difficulties. One key area where federal agencies offer assistance is in loan modification options. These options allow homeowners to modify the terms of their mortgage loans, such as reducing the interest rate or extending the repayment period. By doing so, homeowners can lower their monthly mortgage payments and make them more affordable.

Another important role of federal agencies is to implement mortgage relief programs. These programs aim to provide financial relief to homeowners who are at risk of defaulting on their mortgage obligations. Through these programs, eligible homeowners may receive assistance in the form of loan forbearance, principal reduction, or even temporary suspension of mortgage payments.

Additionally, federal agencies work closely with lenders and servicers to ensure that homeowners have access to the necessary resources and information. They provide guidance on stabilizing the housing market and preventing further foreclosures. By implementing regulations and monitoring the market, federal agencies strive to create a more stable and sustainable housing environment for homeowners and the overall economy.

Recovery and Rebuilding

Stabilizing the Housing Market

After a housing market crash, it is crucial to focus on stabilizing the market and restoring confidence among potential homebuyers. One of the key challenges in this process is addressing the hidden flaws in the housing market that contributed to the crash. These hidden flaws can include inadequate regulations, risky lending practices, and speculative investments. By identifying and rectifying these flaws, policymakers can work towards creating a more stable and sustainable housing market.

Rebuilding Homeownership

After a housing market crash, rebuilding homeownership becomes a crucial task for both individuals and communities. It involves various steps and considerations to ensure a stable and sustainable housing market.

One important aspect of rebuilding homeownership is the home inspection process. This process plays a vital role in assessing the condition of a property and identifying any potential issues or hazards. It helps buyers make informed decisions and ensures the safety and quality of the purchased property.

To facilitate the home inspection process, it is essential to engage qualified and experienced home inspectors. These professionals have the expertise to thoroughly evaluate a property and provide detailed reports on its condition. Their insights help buyers understand the true value of a property and make informed decisions.

Additionally, it is important for homeowners to be proactive in maintaining their properties after a housing market crash. Regular maintenance and timely repairs can prevent further deterioration and increase the longevity of the property.

Overall, the home inspection process is a critical component of rebuilding homeownership. It provides valuable information to buyers and ensures the long-term stability and quality of the housing market.

Lessons Learned

The housing market crash taught us valuable lessons about the risks and vulnerabilities of the real estate industry. One important lesson was the plight of trapped buyers. These were individuals who purchased homes at the peak of the market, only to see the value of their properties plummet shortly after. Many of these buyers found themselves in a difficult situation, unable to sell their homes for a price that would cover their mortgage obligations. As a result, they were stuck with properties that were worth less than what they owed on their mortgages.

Conclusion

In conclusion, a housing market crash can have a significant impact on mortgage obligations. Homeowners may face foreclosure and financial distress as property values decline and interest rates rise. Lenders may experience loan defaults and losses, leading to a tightening of credit availability. The economy as a whole may suffer from reduced consumer spending and a slowdown in the construction industry. It is crucial for individuals and policymakers to be aware of the potential consequences of a housing market crash and take proactive measures to mitigate its effects.

Frequently Asked Questions

What caused the housing market crash?

The housing market crash was primarily caused by a combination of factors, including speculative lending practices, a rapid increase in housing prices, and the subsequent bursting of the housing bubble.

How did the housing market crash affect homeowners?

The housing market crash had a significant impact on homeowners. Many homeowners experienced a decrease in the value of their homes, leading to negative equity. Additionally, mortgage defaults and foreclosures increased, resulting in financial distress for many homeowners.

What are the signs of a housing market crash?

Signs of a housing market crash may include a rapid increase in housing prices, an oversupply of housing inventory, a decrease in home sales, and an increase in mortgage defaults and foreclosures.

What is negative equity?

Negative equity, also known as an underwater mortgage, occurs when the outstanding balance of a mortgage loan is higher than the current market value of the property. This can happen when home prices decline after a housing market crash.

Are there any government programs to help homeowners affected by a housing market crash?

Yes, there are government programs available to help homeowners affected by a housing market crash. These programs may include mortgage relief programs, loan modification options, and assistance from federal agencies.

How can a homeowner avoid foreclosure during a housing market crash?

To avoid foreclosure during a housing market crash, homeowners can explore options such as loan modifications, refinancing, selling the property, or seeking assistance from government programs designed to help homeowners in financial distress.

Can a housing market crash impact credit scores?

Yes, a housing market crash can impact credit scores. Mortgage defaults and foreclosures can have a negative impact on credit scores, making it more difficult for individuals to obtain credit in the future.

What can be done to stabilize the housing market after a crash?

To stabilize the housing market after a crash, measures such as implementing stricter lending practices, increasing housing supply, and providing assistance to homeowners in financial distress can be taken.

The post The Impact of a Housing Market Crash on Mortgage Obligations appeared first on MineBook.me.